Announcement

Collapse

No announcement yet.

Economic pressures

Collapse

X

-

Human nature doesn't change. The problems repeat.

BIBOH is coming...for Election Fraudsters

Last line of his remarks says it ALL; Those who come after us will once again have to risk their lives, their fortunes and their sacred honor to bring back the Republic that this generation has timidly frittered away due to white guilt and political correctness./

So sad, so Very very sad

Last line says it all...

Last line says it all...

TELLING THE SAD TRUTH – NEVER SAID BETTER

Time is like a river. You cannot touch the water twice, because the flow that has passed will never pass again. Franklin Graham was speaking at the First Baptist Church in Jacksonville , Florida , when he said America will not come back. He wrote:

* “The American dream ended " The first term of Joe Biden has been the final nail in the coffin for the legacy of the white Christian males who discovered, explored, pioneered, settled and developed the greatest republic in the history of mankind.

A coalition of blacks, Latinos, feminists, gays, government workers, union members, environmental extremists, the media, Hollywood , uninformed young people, the “forever needy,” the chronically unemployed that do not want to work , illegal aliens and other “fellow travelers” have ended......... Norman Rockwell's America.

You will never again out-vote these people. It will take individual acts of defiance and massive displays of civil disobedience to get back the rights we have allowed them to take away. It will take zealots, not moderates and shy, not reach-across-the-aisle RINOs (Republicans In Name Only) to right this ship and restore our beloved country to its former status.

People like me are completely politically irrelevant, and I will probably never again be able to legally comment on or concern myself with the aforementioned coalition which has surrendered our culture, our heritage and our traditions without a shot being fired.

The Cocker spaniel is off the front porch, the pit bull is in the back yard, the American Constitution has been replaced with Saul Alinsky’s “Rules for Radicals” and the likes of Chicago shyster David Axelrod along with international socialist George Soros have been pulling the strings on their beige puppet and have brought us Act 2 of the New World Order.

The curtain will come down but the damage has been done, the story has been told.

Those who come after us will once again have to risk their lives, their fortunes and their sacred honor to bring back the Republic that this generation has timidly frittered away due to white guilt and political correctness..”

INEPTOCRACY - DEFINITION

Ineptocracy (in-ep-toc’-ra-cy) - a system of government where the

least capable to lead are elected by the least capable of producing,

and where the members of society least likely to sustain themselves or

succeed, are rewarded with goods and services paid for by the

confiscated wealth of a diminishing number of producers.

Comment

-

Here is The Hidden $150 Trillion Agenda Behind The "Crusade" Against Climate Change

It's really all about launching the biggest debt monetization - and wealth transfer - episode of all time.

Is Decarbonization Threatening Europe's Energy Security?

The Greens are trying to force worldwide decarbonization. Europe did NOT replenish it's gas supplies after last winter. Heating oil supplies are at a 10 year low in America.

They are also trying to lock down coal supplies..

Macron Says Small Nuclear Reactors Will Be A Part Of His "France 2030" Energy Pla

Macron said that France was going to build "a low-carbon plane, a small modular reactor as well as two megafactories for the production of green hydrogen" by 2030.

Small reactors look to have a good future. They won't work for transportation. Green hydrogen is a joke at this point.

Watch: BBC Anchor Claims "People Are Over" Arguing Against Surveillance State

“We’ve moved on... Cameras are everywhere...”

Yes, that's the whole f**king point mate!

Beijing Is Trapped: China Producer Prices Surge At Fastest Pace In 26 Years

Victor Davis Hanson: The Left Got What It Wanted - So Now What?

There is no schadenfreude in seeing the Left destroy everything it touches—because its claws tear all of us as well.

Lira Crashes To Record Low After Turkey's Erdogan Fires Three More Central Bankers

Supply Chain Disruptions Force White House To Ask Walmart, UPS, FedEx To Increase Output

Now A US Govt Official Is Telling Us That Supply Chain Nightmares Could Potentially Last For "Years"

This is the taper tantrum that I wrote about.

FOMC Minutes Confirm Tapering Begins Mid-Nov or Dec At $15BN Monthly, Several Preferred "More Rapid" Bond-Buying Cuts

"All participants agreed...a moderation in the pace of asset purchases may soon be warranted..."

Comment

-

Well, things are getting so EEFED up that I don't need to spell out any details with excerpts.

Here is a VERY clear article.

https://dailyreckoning.com/contagion-2/

Here is an article from C.H.Smith with lots of graphs. It is almost painful

https://charleshughsmith.blogspot.co...o-believe.html

The economy is being crashed on purpose. The next step is famine and power shortages.

Here is the playbook on famine.

https://larouchepub.com/other/2008/3...al_famine.html

Comment

-

US Treasury deputy sec warns unvaccinated Americans that shortages will continue until EVERYONE is jabbed | 15 Oct 2021 | The deputy secretary at the US Treasury has put Americans on notice that the only way to end the plague of empty shelves around the country is for every resident to be vaccinated. The frank warning came off as a threat to many. Wally Adeyemo, the Biden regime's second-highest official in the Treasury Department, appeared to publicly blackmail the still-sizable portion of Americans who have not been vaccinated against Covid-19 during a Thursday ABC interview, seemingly blaming them for the ongoing shortages of consumer goods that have led many to mock the president as "Empty Shelves Joe." Despite viral photos depicting thousands of cargo ships lined up at the Port of Los Angeles ready to unload their goods, Adeyemo claimed that the supply chain issues plaguing so many US retailers are an international issue and will only let up when a sufficient percentage of the country has been vaccinated. [1776 time.]

Comment

-

For the facilitation of globalization, capital transfer was made universal and, instantaneous. This so-called "liquidity" can move at light speed. This liquidity took on a life of it's own. It had a self-created reproductive system that allowed debt (disguised as liquidity) to grow INDEPENDENT of wealth. The golden governor was removed to allow the non-producers to enjoy great wealth without actually creating any themselves.. Since the State is the greatest parasite, it wasn't going to curtail faux wealth creation.

Regulatory-capture ensures that this duo of parasites would inflate the "money" supply.

The banks did this to charge interest for loaning money that they did not possess.

The State did this to support itself without actually producing anything.

As usual, the 2 got carried away with plundering. Debt is now about 300% of GDP. 80% is the practical limit for survival.

Liquidity creation went into hyperdrive. Interest rates went to zero or negative.

These 2 factors are the ONLY thing that support the debt bubble.

ZIRP is killing all investment schemes like pension funds.

At the same time, ZIRP is the only thing that allows debt to grow.

The longer that this goes on, the more destructive the unwind will be.

Hard to say just what will set it off.

Too many people measure wealth strictly by the yardstick of money and possessions. They are in for a rude surprise hwhen the yardstick tuns to smoke.

https://dailyreckoning.com/some-ques...ericas-wealth/

Since liquidity can vanish in an instant, movements in the world supply of liquidity affect everybody.

Notes on China;

So now there is a property crisis in China that is making the US mortgage crisis of 2008 look like child’s play in terms of magnitude.

Evergrande, has turned into a total fiasco. It has over $300 billion in known liabilities, plus, according to Goldman Sachs, $156 billion in off-balance sheet debt

China’s residential property market could be the largest in the world with a total asset value of $62 trillion, with a T, compared to $34 trillion for the US property market,

the property sector accounts for about 28% to 30% of GDP,

For years, when a province needed 6.5% economic growth because the central government said so, it cranked up the property sector. Building apartment towers just to increase GDP, whether anyone needs more apartments or not, and finance the whole thing with huge amounts of debt, is problematic,

Chinese property developers, such as Evergrande, all together have $5.2 trillion with a T in debt

For years, there was the assumption among foreign investors when they bought dollar junk-bonds that the government would bail them out when the big S hits the fan

But that assumption is now out the window

The side effect of this one-child policy is that the working age population began to shrink in 2012, and has continued to shrink. This means that household formation is shrinking, which means that demand for apartments to actually live in is shrinking

In 2019, sales of new homes accounted for over three-quarters of total home sales in China, compared to just about 12% in the US

Homeownership is already over 90% for urban households in China, among the highest in the world.

So 1.6 million acres of floor space under construction, at 646 square feet per apartment on average, would mean that there are 108 million apartments under construction.

Let that sink in for a moment: 108 million apartments under construction, when urban homeownership is already 90% and when the working-age population has been declining for nearly a decade.

Total sales among China’s 100 largest property developers plunged by 36% in September from a year earlier, according the Wall Street Journal. Sales by the 10 biggest developers, including Evergrande, collapsed by 44%.

Given how crucial property is to household wealth, a widespread decline in property prices is going to be a gigantic mess. Once apartment prices start declining, they’re no longer perceived as an attractive investment property, and buyers vanish, and prices drop further and sales stall.

But it (GOV) also controlled economic growth by specifying how much growth it wanted, and provinces and cities complied by producing this growth through property investments, construction projects, and the like. But it is this growth model that has led to the current debt-fueled fiasco.

https://wolfstreet.com/2021/10/22/ch...rowth-blew-up/

China is undergoing a power struggle between 2 factions. If they fight to the death, China will completely melt down.

This will be disastrous for global liquidity.

Comment

-

Jim Rickards;

In my 2011 book, Currency Wars, I gave a detailed description of the first-ever financial war game sponsored by the Department of Defense. This financial war game took place in 2009 at the top-secret Applied Physics Laboratory located about twenty miles north of Washington, D.C., in the Maryland countryside.

Unlike typical war games, the “rules of engagement” for this financial exercise did not permit the use of any kinetic weapons such as bombs, missiles or drones. The only weapons allowed were financial instruments including stocks, bonds, currencies, commodities and derivatives.

The game was played out over two days in the main War Room of the laboratory using six teams divided into the U.S., China, Russia, Europe, East Asia, and Banks & Hedge Funds. The contestants included about 40 players on the six teams and another 60 participants including: uniformed military, civilian defense officials, observers from the Treasury, Federal Reserve, CIA and other government agencies, think tanks, universities, and financial industry professionals.

In that original financial war game, a scenario involving Russia, China, gold and the destruction of the U.S. dollar was played out against a backdrop of geopolitical events, including the collapse of North Korea and a threatened Chinese invasion of Taiwan.

In May 2015, the Pentagon sponsored a new financial warfare session, which I was also invited to attend. This time the financial war took place inside a secure meeting facility at the Pentagon itself.

This new financial war game exercise was smaller and more focused than the one in 2009. We had about 20 participants. Our group included representatives from the diplomatic corps, military, think tanks, universities, CIA and the National Security Council. I was one of three individuals from the investment management community.

Our role was not to contemplate the use of aircraft carriers, submarines or missiles in such a confrontation. We were there to consider the use of financial weapons such as disruption of payments systems, cyber-attacks on banks and stock exchanges, and trade sanctions that could cut off supply chains and dry up energy imports.

I learned two lessons that day. The first is that when nations engage in financial warfare, individual investors can be collateral damage.

The most dangerous attacks of all are those in which the enemy penetrates a bank or stock exchange, not to disable it or steal information, but to turn it into an enemy drone. Such a market drone can be used by attackers for maximum market disruption and the mass destruction of Americans’ wealth, including stocks and savings.

If China tries to attack the U.S. by closing the New York Stock Exchange, it will be tens of millions of Americans who will suffer an immediate loss of wealth as prices plunge and accounts are locked-down or frozen.

The second lesson I learned was that future wars will be fought in cyberspace using digital technology applied to payments systems such as SWIFT, FedWire, MasterCard, Visa and Europe’s Target2 system.

Jim Rickards: 16 Intelligence Agencies Have Issued Alarm Report On US Dollar Reserve Status.

" James Rickards, best-selling author of “The Death of Money,” says a huge financial panic is a mathematical certainty. Rickards explains, “It is a mathematical certainty, but I can take it further . . . what you don’t hear is this will be exponentially larger than any financial panic in the past. .

Comment

-

All fiat currencies in history have failed. U.S. GOV knows this very well.

Traditionally, when a national currency failed, the State had a new currency ready to go.

They knocked off 3 zeros and, rebooted the system.

(Old number) 51% of Americans receive a check from GOV.

The State tried to grow without limitations. There is nothing more limiting than the gold standard.

Pox Americana would very much like to continue supporting it's military enough to continue ruling (thrashing) much of the world.

The reboot from a dollar collapse will impoverish America so much that it would have 2 choices;

North Korea style, with a big military and, the people starving

OR

The people surviving reasonably well but, a huge shrinkage of the military & State.

Pox Americana chose to keep going down the militaristic path.

This necessitates killing off as many of the non-producers as possible.

This necessitates locking down everybody who is left.

Covid 19 and, covid 20 (the disease from the syringe) were expected to kill off many millions.

The resulting covid passport was expected to physically & metaphorically lock down any & all resistance against the depredations of the State.

The Cleveland FED said that everybody will have an account at the FED and, the private banks will be gone.

Klaus Schwab says that you will own nothing.

The dollar collapse has been a long time coming.

The FED-coin has been a long time in the planning.

Same for the vaccine passport.

How digital vaccine passports pave way for unprecedented surveillance capitalism – GZ

I daresay that you can't call it capitalism if you don't own anything.

The State saw collapse on the horizon. It is now thrashing around to ensure IT'S survival at the expense of everyone else.

Comment

-

You see the problem here: the risk of crashing and expiring is soaring but the giddy occupants are completely confident there's no risk, and this confidence is the source of the danger.

The irony is rich: the greater the confidence, the greater the risk, the greater the risk, the greater the odds of a crash. The greater the risks being taken, the greater the odds that the crash will be fatal to all occupants.

https://charleshughsmith.blogspot.co...curve-few.html

"Are We A Socialist Nation?" - Cooperman Slams "Stupid" Plan To Tax 700 Billionaires

10/26 Bond market crash will surprise only the uninformed – Zero Hedge

The asymmetry of ineffective and worthless QE – Real Clear Markets

Well, if you are a non-producer and,,, printing is all you know,,,, you continue to print.

Will The 'Billionaire Tax' Collapse The Market (And Other Anti-Fragile Talebian Takes)

Loonie Soars After Bank of Canada Ends QE Early, Accelerates Potential Timing Of Rate Hikes

This is very important to consider. If Canada is tapering, they can't do it for very long unless America tapers.

30Y Gilts Soar Most Since Covid Crisis In Giant Short Squeeze After UK Slashes Debt Issuance

The UK is tapering. How long before America follows?

UST Yield Curve Tumbles To 18-Month Lows Amid Policy Error Panic

“The longer this persists, the greater the risk of a historic policy error whose negative implications could last for years and extend well beyond the U.S.,”

The American markets consider any tapering to be a grave POLICY ERROR.

What Is The Federal Reserve Hiding From Us?

“The most inappropriate monetary policy that I’ve seen maybe in my lifetime.”

The FED was pushing on the gas pedal. Now, they are moving to the brake pedal.

Futures Slip From All Time High Amid Fresh China, Growth, Valuation Concerns

At this point, China is very close to being a "dead man walking"

They have attacked the rich because Marxism is the only thing that they know. Major companies are pulling out.

They started out with Jack Ma.

Now, they are demanding that the rich pony up LOTS of money for the not-rich.

Moscow Outraged After German Defense Minister Advocates 'First Use' Nuke Policy Against Russia

As long as they don't nuke the oil pipeline that keeps Germany from Freezing.

Defining The State Is No Secret

Barack Obama in a 2008 interview bluntly defined the state as possessing "a monopoly on violence"...

We shall see.

Comment

-

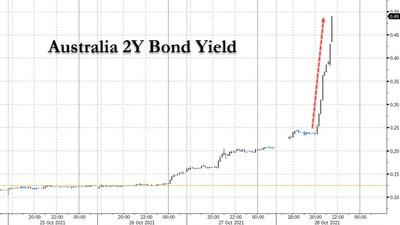

The Taper Tantrum Has Begun: Australia's 2Y Bond Just Blew Up After The Central Bank Unexpectedly Refused To Buy It

VaR shock coming to every yield curve near you.

THU OCT 28, AT 3:11 AM

The Bank for International Settlements coordinates the actions of member banks.

In this case, the Central Bank refused to buy State debt.

This is an indication that CBs around the world will follow.

Previously, when the CBs tightened, there was a general meltdown and, they were forced to back-pedal.

The State finances itself by selling bonds AND printing new currency.

When it prints new currency, it steals some of the value of existing currency

We pay the inflation tax.

When it sells bonds, we must pay the interest premium.

However, when the State inflates the currency supply, it causes price inflation.

This price inflation must be subtracted from the premium paid out on Treasury bonds.

Bonds pay close to zero but, inflation is close to 11%.

The State finances itself at the expense of every other sector.

There is an across-the-board loss to every investment and, every interest-paying arrangement.

ZIRP chips away at every non-State person & entity.

The State is now proposing a billionaires tax. A simple admission that it has no intention of ever shrinking.

Additionally, the State plans to do away with paper currency so that it can more effectively steal the value of your savings.

https://www.imf.org/external/pubs/ft...15/wp15224.pdf

It will tax paper currency out of existence.

If the State plans to steal the value of your savings, what makes you think that it will allow you to use BTC or crypto coins to hide away savings?

GOV just came out with a BIG new regulatory structure for crypto.

If you can't exchange crypto for fiat, it has no real value.... other than barter. Somebody has to eventually do this exchange.

If you can exchange crypto for fiat, everything will be recorded.

Comment

-

Last month, the New York Stock Exchange (NYSE) announced it had developed a new asset class and accompanying listing vehicle meant “to preserve and restore the natural assets that ultimately underpin the ability for there to be life on Earth.”

These NACs will then maintain, manage and grow the natural assets they commodify, with the end goal of maximizing the aspects of that natural asset that are deemed by the company to be profitable.

Though described as acting like “any other entity” on the NYSE, it is alleged that NACs “will use the funds to help preserve a rainforest or undertake other conservation efforts, like changing a farm’s conventional agricultural production practices.”

Yet, as explained towards the end of this article, even the creators of NACs admit that the ultimate goal is to extract near-infinite profits from the natural processes they seek to quantify and then monetize.

https://childrenshealthdefense.org/d...2-c990fd47fedb

History repeats all the time. With digital currencies, the next war may not be counterfeiting the paper currency of an opponent. This time, they will have to hack the banks and wipe out people’s savings to economically undermine their economy. This means that every bank will become a target to hackers, whereas traditionally in war you simply attack the currency of the sovereign."

Attack the banks,,, what a novel idea.

https://www.armstrongeconomics.com/w...war/war-money/

10/28 The global supply shock is about to enter a negative feedback loop – ZH

10/28 6 charts that show the coming economic implosion – GoldSilver

10/28 St. Louis Fed’s Bullard would ‘support starting the taper in November’ – Today UK

Let's see how long that lasts.

10/28 Skimpflation, shrinkflation and the rebellion of workers and consumers – CHS

RBA Calls Bond Market's 'Taper Tantrum' Bluff, Yields Explode Higher Again

Three Ways Government Spending Is Ripping Us Off

Control the government spending or suffer the sad and inevitable consequences of disastrous policies...

96 Billion Reasons Why The Treasury VaR Shock Is About To Get Worse

Comment

-

EXCELLENT article

"Nearly half that sum (44%) consisted of a reallocation of corporate equity to shareholders at the expense of worker compensation, while economic growth accounted for just 25% of that increase in wealth. In other words, despite the advent of seemingly near-miraculous, time- and space-saving digital technologies, the post-Cold War “economic boom” consisted mainly of America’s wealthy shareholders taking money from its increasingly insecure workforce."

https://www.tabletmag.com/sections/n...ential-workers

"America, and other Western societies, had moved from a model of real growth and expanding benefits for all to a model where the rich got richer by impoverishing the less wealthy orders of society"

During the lockdown

"1 in 4 households experienced food insecurity, and 200,000 small businesses closed. The result was an estimated loss of $1.3 trillion in household wealth for American workers. Meanwhile, U.S. billionaires gained $1 trillion."

"COVID-19 era—an era that has seen the greatest upward wealth transfer in modern history. As a result of lockdowns, between 143 million and 163 million people worldwide have fallen into poverty and there was a sixfold increase in the number of people suffering through hunger and starvation. At the same time, tech companies like Amazon, Alphabet, and Microsoft saw record profits."

S&P Tops 4,600 In Fitting End To Best Month Of 2021

Largest US Homeowner Raises Rents As Housing Crunch Persists

Fed's Favorite Inflation Indicator At 30-Year-High As Savings Rate Plunges

40% Of The Bull Market Is Due Soley To Buybacks

...the market would be 2700 without share buybacks.

Exxon Surprises With $10 Billion Stock Buyback Announcement As Cash Flow Soars

San Francisco Gas Prices Hit All Time High, Average Near $4.75 Per Gallon

China is never far away from it's Marxist roots.

Coal Prices Halved As Beijing Central Planners Step Up Interventions

Beijing put a ceiling on coal prices so, there is no profit.

Electricity production is way down. Companies are running diesel generators to make up the difference.

China's Energy Crisis Spreads As Gas Stations Run Out Of Diesel

Waypoints On The Road To Currency Destruction (And How To Avoid It)

The few economists who recognize classical human subjectivity see the dangers of a looming currency collapse.

10/29 Expected cuts to Treasury auctions may be ‘calm before the storm’ – Kitco

surprise tapering

10/29 Interest rate options market bets on aggressive Fed hikes – Reuters

Projected tapering

Comment

-

China is rattling sabers in the direction of Japan.

Samsung Shifts Production From China To India and Invested $75 Billion

https://www.youtube.com/watch?v=n7-5YqZin4U

China (Xi) got pissed off when OZ insinuated that China may have been the source of the Wuhan flu.

China quit importing coal from OZ and now, has huge shortages.

One year ago, Ma was the richest man in China. He was the creator of Alibaba – China’s largest tech company – and The Ant Group, the largest Fintech company in the world. His corporate empire had reached private-sector superpower status, on a par with the Western FANG-giants. Alibaba alone was worth more than any U.S. company except for Apple, Amazon and Google.

“It is hard to overstate the importance in China of Mr. Ma and his two companies. They have become synonymous to innovation.

Ma’s assets have been stripped, shorn, and degraded (“rectified” is the English word often given as the translation for whatever verb in Chinese describes what Beijing is doing to his businesses).

Beijing took note. Ant’s business was thrown into reverse, shrinking 18% in the first quarter of this year, and down almost 50% from its peak.

https://www.forbes.com/sites/georgec...h=7f4126c5123a

As China goes broke ( as all command economies do), it's Marxist roots will come into play more and more.

Jack Ma got rich by being innovative. Innovation is almost totally absent in communist economies.

Marxist economies depend on parasitism, NOT innovation. They consume their seed corn.

The Federal Reserve,,, of all entities,, is writing that the lockdowns, etc are causing a nationwide health crisis that is reducing both health AND GDP.

https://www.armstrongeconomics.com/b...mental-health/

The PTB that brought us covid19 and, sequentially, covid 20 did NOT count on there being any escape from their diabolical plans.

They did NOT count on Ivermectin & hydroxycloroquin.

They also did not count on religious exemptions.

Judge Rules Against Biden’s Violation of Religious Exemptions

SCOTUS is on the job.

Supreme Court Declines To Block Maine COVID-19 Vaccine Mandate For Health Workers

Litigation to continue in lower courts for health care workers seeking religious exemption...

Bond bloodbath and horrible liquidity

Tapering seems to have taken hold.

Americans' Biggest Fear Is "Corrupt Government Officials"

For the fifth year in a row, "corruption of government officials" led the ranking with 79.6 percent of respondents saying the prospect made them "afraid" or "very afraid"...

I wonder WHY?

Victoria To Make Emergency Powers PERMANENT

Armstrong, ""From a strategic position, if I were Xi, as civil discontent rises in China, the best way to deflect that historically is always to point to an outside enemy. I would expect that if China is going to invade Taiwan, the best time is now under Biden. His administration is so focused on Build Back Better and his own Party is deeply divided, by the first quarter of 2022 would be ideal. What is Biden really going to do? Europe is virtually defenseless. He has insulted the military and the Progressives want to take the military funding and move it to AOC’s New Green Deal. The West is so divided and messed up, it is now or never.

https://www.armstrongeconomics.com/i...n-opportunity/

Shadowstats shows that price inflation is rising by about 11--12%

10/29 Invitation Homes boosts rents 11% as housing shortage persists – BNN

Many entities will try to raise prices to compensate for inflation.

Comment

-

I'm trying to expose the heart of the matter.

The State made far too many promises of support. It is going bankrupt trying to pay for social obligations.

By moving covid-infected people into STATE run nursing homes, Governor Cuomo removed 32,000 people who were receiving State support.

This is a microcosm for what is happening worldwide.

Both remdesivir and ventilators are a death sentence. In SOME areas, the doctors have caught on and, won't use them.

Watch: MEPs Protest "Oppressive" Vaccine Passports, Question Why "Political Elites Push This Agenda This Hard"

...two of the truest minutes in the EU’s history...

Most of the political elites serve no purpose to society. THAT is why they absolutely insist on our compliance AND registration.

https://www.youtube.com/watch?v=7gwcQjDhZtI&t=604s

The elites LOUDLY complain about democracy.

They want to see THEIR will done, NOT ours.

In a perfect democracy, everybody works and, everybody votes.

Since society has very little use for the State, the State bureaucrats must somehow prove their value.

With huge advances in artificial intelligence, there is very little justification for having a political class.

Hundreds of millions of bureaucrats shuffle papers back and forth to each other.

The politicians & bureaucrats are working furiously to avoid the fate of the working class. AI could be their death knell.

A bureaucracy is used to digest and, manipulate information.

AI can do a much better job that human bureaucrats.

AI can do a much better job of management that crooked, egotistical politicians.

World’s largest hedge fund to replace managers with artificial intelligence

Worlds largest bank uses AI for all loans.

The politicians & bureaucrats are fighting tooth & nail to hold on to their job niche.

Alex Gutentag clearly shows that corporate America shifted it's profit structure to enrich stock holders at the cost to the actual workers / producers.

https://www.tabletmag.com/sections/n...ential-workers

Rand corporation clearly shows the cost to the American worker to be just over $50 trillion.

America was previously a high wage--high cost economy.

The suppression of worker's wages made it a low wage--high cost economy.

It would naturally revert to a low wage--low cost economy.

$trillions are being pumped in to block the falling value of assets.

In the crack-up boom, the central bank attempts to sustain the boom indefinitely without regard to consequences, such as inflation and asset price bubbles.

Once the central bank decides to accelerate the process of credit expansion and inflation in order to head off any recession risk, then it continually faces the same choice of either accelerating the process further or facing an even greater risk of recession as distortions build in the real economy.

Mises, "There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved. "

Several Central banks are moving towards cutting back on credit creation (tapering)

We could be seeing the voluntary abandonment of credit expansion. It is FAR too late for that now.

Keep in mind that the State is only worried about STATE finance.

Losing control – Credit Bubble Bulletin

10/31 Lawrence Lepard: thoughts on the moral basis of sound money – NOIC

The State is an immoral parasite. It has NO interest in sound money.

10/31 ECB loses control of front-end as inflation comes in scorching hot – ZH

The ECB is not yet talking about tapering because it is so very socialist and, has the most social commitments.

10/31 The Fed’s assets from crisis to crisis to raging inflation – Wolf Street

10/31 Supply chains need $100 trillion to become net-zero by 2050 – PSW

It all gets down to energy,,, mostly to oil.

Russia has lots of oil. NATO has gradually encircled Russia. Pox Americana has put "training Centers" in Ukraine that are just thinly disguised bases.

https://www.youtube.com/watch?v=oahMCNdh2Ng

10/30 NATO sliding towards war against Russia in Ukraine – Strategic Culture

A.I. has destroyed much of the world's job market.

Productive employment is way down.

State employment is way up.

Wages are falling at the same time that energy prices are rising.

The plandemic is seem as a way to repair fiscal balance sheets by killing off millions of non-producers.

Vaccine identification schemes are seem as a way to completely register the remaining people.

Central bank Digital Coins are seen as a way to provide eternal finance to the State.

The 2 of these are seen as the road forward for total control by our fascist overlords,,,, banker & politicians.

Comment

Comment