Announcement

Collapse

No announcement yet.

Economic pressures

Collapse

X

-

White hats anticipated deep state's new strategies to get replacement money for sanctuary cities who have been cut off and at the same time ruin the Trump economy, all countermoves. Military planning at it's finest. Weaponized virus attacks thru the MSM democratic arm. Same dance different day. Deflate for a while and ride the Trump train up to 40 G's

Don't buy, just sit home and pray, hoping you don't die soon

Don't buy, just sit home and pray, hoping you don't die soon Easy money for the machine.

Easy money for the machine.

Comment

-

I'll just post some headlines. MSM is pushing the panic button. It doesn't really matter if it is a false panic or not. Panic will affect the markets.

Dow Dumps 2000 Points, Markets Extend Losses After Circuit-Breaker

Market Crash Reveals The "Liquidity Problem" Of Passive Investing

Someone Just Bet That VIX Will Top 100 By Tomorrow

VIX is the fear gauge

Doug Kass: When Two Black Swans Collide

in scope and rapidity, the accumulated declines in bond yields and stock prices are unprecedented...

European Stocks Crash Most 'Since Lehman', Enter Bear Market

Global Recession "Appears Inevitable" - Guggenheim's Minerd Fears Cascading 'Butterfly Effect'

"This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."

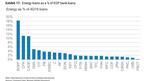

These Are The Banks With Most Energy Exposure

.. banks will need to reflect life time losses for their oil exposures at an oil price today that is roughly half of what it was on December 31,2019 when it ended the year at ~$66

"There Is No Liquidity" - Market Paralyzed As FRA/OIS Explodes

The Dow Is Down 8% - The Biggest Drop Since 1987

BMO: The Biggest Risk Is Not The Crash, But How Long Asset Prices Remain At Current Levels

3/09 Jim Cramer: coronavirus has brought about the end of monetary policy – CNBC

3/09 US stocks plunge as all-out oil price war adds to virus stress – CNBC

3/09 The fiscal & monetary responses Goldman expects will be launched any minute – ZH

3/09 VIX tops 60 – highest since 2008 – screams “intervene now!” – Zero Hedge

3/09 Market stress building at fastest pace since Lehman – Bloomberg

3/09 First time ever: entire yield curve crashes below 1.0% – Mish

3/09 New York Fed increases repo lending by 50% – GATA

3/09 Today might may end the pretense of a market economy – GATA

The Moscow Radiotechnical Institute of the Russian Academy of Sciences has registered a patent for a system of transmitting energy from an orbiting solar power plant down to the surface of the Earth, according to data on the website of Russia's Federal intellectual property service.

They're going to use microwave power.

The Air Force Research Laboratory (AFRL) in Albuquerque, New Mexico, in partnership with Northrop Grumman, is reportedly designing a sophisticated orbital technology that would allow the collection of enormous amounts of solar energy in space before beaming it down in concentrated form

WHY does this sound like duelling microwave wars?

Comment

-

-

David Morgan makes it pretty clear. The only reason that REPO demand is screaming up is because; the private, interbank REPO market is UNSECURED. Banks won't even loan overnight to other banks. When it comes to trust, the banks just don't trust each other. The FED REPO window is the only window with cash.

https://www.youtube.com/watch?v=x3NST0QI4XU

Don't worry about the banks. They have a plan.

Banker-heavy Biden cabinet ‘leak’ triggers outrage, echoes of Obama’s ‘Citigroup cabinet’

Ellen Brown;

"the stock market plummeted. Over the following week, the Dow Jones Industrial Average dropped by more than 3,500 points, or 10%. In an attempt to contain the damage, the Federal Reserve on March 3 slashed the fed funds rate from 1.5% to 1.0%, in its first emergency rate move and biggest one-time cut since the 2008 financial crisis. But rather than reassuring investors, the move fueled another panic sell-off.

Exasperated commentators on CNBC wondered what the Fed was thinking. They said a half-point rate cut would not stop the spread of the coronavirus or fix the broken Chinese supply chains that are driving U.S. companies to the brink. A new report by corporate data analytics firm Dun & Bradstreet calculates that some 51,000 companies around the world have one or more direct suppliers in Wuhan, the epicenter of the virus. At least 5 million companies globally have one or more tier-two suppliers in the region, meaning that their suppliers get their supplies there; and 938 of the Fortune 1,000 companies have tier-one or tier-two suppliers there. Moreover, fully 80% of U.S. pharmaceuticals are made in China. A break in the supply chain can grind businesses to a halt."

So what was the Fed’s reasoning for lowering the fed funds rate? According to some financial analysts, the fire it was trying to put out was actually in the repo market, where the Fed has lost control despite its emergency measures of the last six months. Repo market transactions come to $1 trillion to $2.2 trillion per day and keep our modern-day financial system afloat."

"As I explained in an earlier article, the private repo market has been invaded by hedge funds, which are highly leveraged and risky; so risk-averse money market funds and other institutional lenders have been withdrawing from that market. When the normally low repo interest rate shot up to 10% in September, the Fed therefore felt compelled to step in. The action it took was to restart its former practice of injecting money short-term through its own repo agreements with its primary dealers, which then lent to banks and other players. On March 3, however, even that central bank facility was oversubscribed, with far more demand for loans than the subscription limit."

"This continuing liquidity crunch is bizarre, as it means that not only did the rate cut not unlockadditional funding, it actually made the problem worse, and now banks and dealers are telegraphing that they need not only more repo buffer but likely an expansion of QE"

"The problem is in the collateral, which lenders no longer trust. Lowering the fed funds rate did not relieve the pressure on the Fed’s repo facility for obvious reasons: Banks that are not willing to take the risk of lending to each other unsecured at 1.5% in the fed funds market are going to be even less willing to lend at 1%."

The central bank has become the only game in town, and its hammer keeps missing the nail. A recession caused by a massive disruption in supply chains cannot be fixed through central-bank monetary easing alone. Monetary policy is a tool designed to deal with demand — the amount of money competing for goods and services, driving prices up

https://www.truthdig.com/articles/th...rus-explained/

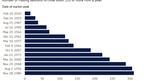

3/10 Funding freeze getting worse: dealers demand record $216bn from Fed repo – ZH

3/10 New York Fed increases repo lending by 50% – GATA

3/10 Fed rates at 0% expected within months amid global bond frenzy – GATA

MY TAB JUST CRASHED AND, RESTORE DIDN'T KEEP IT ALL.

UK Health Minister Tests Positive For COVID-19; Bernie And Biden Cancel Rallies: Live Updates

So, what is that going to do for confidence?

Saudi-Initiated All-Out Oil War Could Lead To Collapse Of Kingdom Itself

3 months ago, Ex-CIA Chief Petraeus: Saudis "Running Out Of Money" & Urgently Need Aramco IPO Cash

The Saudi leadership may suddenly find that the internal situation in the Kingdom is being worsened by large-scale protests rapidly turning into an open civil conflict...

MbS started arresting other royals. He turned them all against him. 70 percent of working Saudis are employed by the government; They only show up for one hour a week. They can easily be turned against MbS now that the cushy jobs are vanishing.

"Dead Bat Bounce" Dies - Dow Futs Down Over 500 Pts, Treasury Yields Are Tumbling

As money seeks safe-haven treasuries, the interest earned on them falls. This creates deflation in available funds. This drives up the amount needed for REPOs.

Coronavirus Threatens To Crash The Gig Economy

"Seattle is rapidly approaching post apocalyptic ghost town levels. Pike Place and Westlake are the emptiest I’ve ever seen."

The Price of Homelessness: The Seattle area spends more than $1 billion a year on this humanitarian crisis

Only 4 Shale Drillers Are Still Profitable At $31 Oil

White House Promises "Cost Will Not Be A Barrier" For Coronavirus Care But Offers Few Details About "Bold" Trump Stimulus Plan

"President Trump said at Monday's coronavirus task force press conference that his administration will press lawmakers to enact a payroll tax cut and provide assistance to hourly workers to make sure no one is financially impacted by the coronavirus pandemic.PRESIDENT TRUMP: We are going to take care of and have been taking care of the American public and the American economy. We are going to be asking tomorrow, we're meeting with the Senate and House Republicans to discuss a possible payroll tax cut or relief, substantial relief, it is a big number. We're also going to be talking about hourly wage earners getting help so they can be in a position where they're not going to ever miss a paycheck."

https://www.realclearpolitics.com/vi...lclearpolitics

February Heavy Duty Truck Orders Plunge, New 2020 Estimates Call For A 31% Drop

"Brace For Impact" - The Real Economy Is Degrading Very Quickly

"Deeper Than Corona" - The Real Causes Of The Oncoming Economic Collapse

Goldman: VIX Options Signal "Normalization Is Increasingly Distant"

Comment

-

80132dff4a29a71938d7d351b5db52ebdfe5908de4ca961fcee3e119ea5eff0c.jpg

Here is what is really happening with the TRUMP plan. Avoid this video if you are a skeptic. 10 min or so might be an overdose I know.

10 min or so might be an overdose I know.

Last edited by BroMikey; 03-11-2020, 03:50 AM.

Comment

-

Never let a good crisis go to waste? Trump is pushing tax reform. For corona scare.Originally posted by Danny B View PostSorry Mikey,,, no can do. @3:20 they report that confidence is rising. NOPE. The lockdowns are what is coming.

Sorry? There there, it's gonna bee okay I'll learn ya dern ya.

I'll learn ya dern ya.

Here is the low down. X22 report just got Q'ed. Understand? The people who are scared are going to freeze up and lose mula. So what's new?better get in soon, she is going to sky rocket.

What do you think about this pablo? I like this stuff but I like your more comprehensive inputs as well.

Speak to the wind SON OF MAN? Do you understand?

Last edited by BroMikey; 03-12-2020, 03:09 AM.

Comment

-

Government, in general seems to lean towards a total lockdown. That certainly isn't going to help, the economy.

"Fallen Angel" Day Arrives: $140 Billion In Energy Debt At Risk Of Imminent Downgrade To Junk

Fracking already lost $280 billion. The attack of Saudi on Russia has shoved most frackers into insolvency.

https://www.zerohedge.com/personal-f...ng-catastrophe

"Yet under a fiat monetary system, inflation and deflation can take on excessive proportions. I fear that the ketchup parable of inflation holds up. You shake and hit the bottom of the ketchup bottle, but nothing comes out. Suddenly, the ketchup splashes onto your plate, on the table and on your shirt in a burst. It is the same with money inflation. The central banks push and shake, and no price inflation appears, until it suddenly comes as a massive burst of price increases and as hyperinflation."

"What a chart like this basically says is that every buyer in the past 13 months (who didn’t sell) is under water. That’s a lot of buying.

Anybody that has bought stocks in the past year has been taken to the cleaners. ETFs, pension funds, institutions, hedge funds, buybacks, retail, you name it.

This is mass destruction. And ALL are praying right now for a big rally to break even"

https://northmantrader.com/2020/03/10/destruction/

Kyle Bass is real cheerful.

https://www.marketwatch.com/story/th...ass-2020-03-09

3/11 Some energy companies ‘will not survive’ oil rout slamming markets – MarketWatch

Pray that Putin doesn't slam any doors shut.

3/11 Goldman Sachs says oil has a lot more downside risk – Bloomberg

WTI Extends Losses After Huge Crude Build Indicate Significant Virus Impact

3/11 Boeing to drawdown full $13.8 billion revolver, hinting at bank lending freeze – ZH

Boeing is TOAST. Another one fo their new plane models is garbage.

Tuesday, Boeing reported that it didn't receive any new orders for commercial jets in January, compared to 45 orders a year ago

The 737 Max isn’t Boeing’s only airplane that suffers from malfunctions. Its new aerial refueling tanker — the type of plane that makes it possible for the Air Force’s aircraft to traverse long distances while being based a safe distance away from enemy attacks — is also riddled with problems.

And yet, the Pentagon earmarked $2.85 billion in the 2020 budget for 15 Boeing aircraft it can’t use — while retiring 29 refueling tankers that still work fine

Orders Plunge For Italy's Luxury Suppliers Amid Nationwide Lockdown

"We don't have orders for April or May either. The company has been brought to a standstill..."

Italy Suspends Mortgage Payments, Businesses Dying As Panicked Residents Hoard Food

Double Whammy Of Shocks Plagues Companies Across World As Virus Spreads

Lagarde Warns European Economy Faces '2008-Style Crisis' Without 'Coordinated' Government Action'

Sorry, Europe doesn't have a prayer.

Tokyo Games Official Raises Possible Delay, Japanese Govt Says "Inconceivable"

US House Covid-19 Economic Relief Bill To be Announced Wednesday With Floor Vote Thursday

They say that it will take many weeks to get it all worked out.

WHO Declares Covid-19 A Pandemic, Deeply Concerned At "Alarming Level Of Inaction"

Liquidity Getting Worse By The Day: Fed Injects Record $132 Billion With Overnight Repo

Fed Boosts Size Of Repo Bailout Facility For 2nd Time In A Week Following Liquidity Collapse

The private banks are seizing up.

Blain: "There Just Isn't A Plan!!"

YOU BETTER MAKE YOUR OWN PLAN.

Earnings Expectations Are Starting To Plunge: Here Are The Most-Impacted Sectors

Trump Bans All Travel From Europe For 30 Days; Tom Hanks Infected; NBA Suspends Season: Live Updates

Nasdaq Futures Limit-Down, Crude Crashes After Trump Announces EU Travel Ban

Banking Crisis Imminent? Companies Scramble To Draw Down Revolvers

Stock Buybacks Crash Just As Markets Need Them Most

CME To Close Chicago Trading Floor On Friday The 13th

Comment

-

"Speak to the wind SON OF MAN? Do you understand?'

Sorry, it's over my head.

Just some more headlines.

Lagarde Explains How Even More QE Will Fix CV Crisis

US Media Outlet Says Russian Oil Companies Can Survive Price of $15 Per Barrel

Russia-Saudi revenge against shale oil threatens to crush entire US financial system

"Bracing For Impact" - China Shock To Strike Germany's Largest Port In Days, As Trade Volumes Collapse 40%

Banks;

https://www.zerohedge.com/markets/gl...ash-record-low

Panic;

http://www.alt-market.com/index.php/...n-anything-yet

Mr. Armstrong; You have warned that the European bank stocks were in real trouble. They have really collapsed.

You can see for yourself that they have not been able to recover and here we have really crashed and burned.

"In the midst of this market turmoil, the New York Federal Reserve stepped in midday Thursday and announced a major asset purchase program. It offered $500 billion in three-month Repo operations, $500 billion in one-month Repo operations, and another at least $220 billion in operations with a duration of two weeks or under. This is a joke as was the rate cut. Rates rise in such panics because banks do not want to lend fearing credit risk and borrowers are not interested until the market settles. The rate cut was futile and the proof of the was the expansion of the Repo facility otherwise short-term rates would explode to probably 20%+.

There is nothing the central banks can do and this is becoming more and more obvious to the real money. We are entering a period we could call Central Bank Erectile Dis-function"

Armstrong claims that interest rates would go MUCH higher if the FED was not pumping in money. This would freeze up EVERYTHING.

"ANSWER: Yes. We will most likely come to another credit crunch at the end of the quarter. This time we have a confrontation between real interest rates, which are rising due to credit risks that is part of the Repo Crisis, and the artificial lowering of rates under Keynesian economics to stimulate demand irrespective of credit risk. We are facing a true clash of the free market v the fake market."

3/13 How big is that Fed liquidity pump? $1.5 trillion or $5 trillion? – Mish

3/13 Fed to inject $1.5 trillion in liquidity but markets plunge again – Mish

3/13 Bazooka backfires: Fed’s massive repo operation fails to fix liquidity crisis – Zero Hedge

3/13 Italy bans short sales, blames Christine Lagarde for stock market plunge – ZH

3/13 Asian-Americans concerned about virus backlash, are buying guns – Newsweek

Why does that sound like very bad news?

"They" must have some ulterior motive but, it isn't completely obvious at this point.Maybe, like the twin towers attack, there are several motives.

Comment

-

Thank you for giving me the opportunity to explain. I'll start with a slogan everyone knows.Originally posted by Danny B View Post"[SIZE=14px]Speak to the wind SON OF MAN? Do you understand?'

Sorry, it's over my head.

"THE POWER OF POSITIVE THINKING" The power of words is enormous. Everything people DO is first something they THINK of and then SPEAK about. After that they DO IT. Your words are valuable to the powers of light and darkness. The darkness would like you to repeat their filthy unlawful thought processes while the forces of light hope you go with better.

THE SON OF MAN is a reference to God's man speaking about the light. Conversely witchcraft is the art of speaking lies while getting peeps to believe it. Speaking truth is also powerful but often not as excepted nor are there many reinforcing validating voices that comes to IT'S rescue. Sadly people believe lies quicker especially when repeated by millions.

Repeating unverified information will magnify the content. Mockingbird media is doing just that. 6 corporations own all of the mockingbird media outlets. The controller of these 6 corporations produce their brand of news based on their agenda not on free speech or truth.

We need to think for ourselves. RULE NUMBER ONE if everyone is repeating it or saying something they got from the MSM it is probably false or at best a twisted representation of the global agenda. The examples are endless. When THE SON OF MAN speaks the words are foreign due to the endless MSM mind controlling programming.

This why it seems so remote to speak from a premise of positive thinking. When God's man speaks peeps have no clue.

Once you understand the MSM playbook it is all down hill. The controller worship Satan. THEY are perverts with a dark agenda.

The question becomes "What is a good source for true news"? THE WIND is a reference to the spirit or mood. Like throwing seed to the garden on a windy day. That is how true news is received by the people, they are confused. Truth or true news would be found on a local level not something repeated exactly the same way by thousands of news outlet all at the same hour on the same day. That is the truth of the 6 corporate ruling heads.

Last edited by BroMikey; 03-13-2020, 06:04 AM.

Comment

-

Mikey, you're absolutely correct about the mocking bird media. I post a stack of news and, it is up to you to filter it. I'm trying to lighten the load of reading. I skip a lot of stuff that I know is pure BS. The less that you have to read, the more likely that you are to, take on a subject. There are certain subjects that are observable all around us. The primary ones being;

The falling birth rate

The inroads of automation into the job market

The outsourcing of jobs to the BRICs

The huge loss of employment niches for un-intelligent people

The runaway growth of the financial industry

The scourge of crony capitalism

The wars of opportunity

The role of israel in promoting worldwide organized crime

Et al

Keeping all of this in mind. there are many logical outcomes that are easy to rationalize and believe. I try to stay within the bounds of logic. Everything about the Twin Towers attack was very logical. Promoting the Afghan drug trade for decades is very logical,, etc, etc

Rational people, EVEN DICK CHENEY, generally follow a logical path to get what they want. You just have to adopt a different mindset to see the logic of ,,,, starting interminable wars,,, I try to post stuff that fits into a logical puzzle.

Here are 2 articles that are too important to break up into cites.

https://asiatimes.com/2020/03/how-bl...-planet-panic/

https://www.goldmoney.com/research/g...gmrefcode=gata

I understand a lot of economic / political stuff but, these are beyond my keen.

Comment

-

Danny nice reporting, don't stop but read thru a lens ready to hit the BS button. Number One ALL media is in some way controlled by the big money. What we get is slanted ALL. Look at it that way. The slightest altered fact tips over the whole boat of lies. We still need to read the BS so we can hit the button and mentally rewrite

We still need to read the BS so we can hit the button and mentally rewrite

Comment

-

The mess gets messier

I'm amazed at the level of panic I see at the grocery stores. Panic begets more panic.

"Look at the phase change in attitude that has happened in the past 2 weeks.

The public went from complacent to panicked. The markets tipped from greed to extreme fear.

That’s with less than 2 thousand known covid-19 cases in the US.

What will be like if the models are correct, and we have *4 million* cases in two months?"

Anger at the government.

https://www.rt.com/uk/482924-cornona...gh-parliament/

Anger at government actions.

https://www.scmp.com/news/china/soci...15840399085499

"All of this is being done to save lives.

But in the process, it is going to absolutely kill the economy.

At this point, President Trump is even thinking about imposing “travel restrictions within the United States”…

even if the U.S. was totally locked down for 30 days, this virus would just keep coming back into the U.S. from other countries that are not locked down.

So the truth is that we would need the entire globe to be completely locked down for an extended period of time to really defeat this pandemic, and that simply is not going to happen."

The severity of the virus may be just a hoax. But, the crash in the markets seems to be fact.

3/14 Nomura: “the market has only just begun staring into the abyss” – Zero Hedge

3/14 Municipal bond issuers halt billions of sales in market rout – Bloomberg

First the municipal bonds collapse,,, then State bonds,,, then federal

3/14 Bitcoin loses half of its value in two-day plunge – CNBC

Did you hear that the same thing happened to gold??? Neither did I.

3/13 Fed to inject $1.5 trillion in liquidity but markets plunge again – Mish

3/12 Six million Australians to receive $750 coronavirus stimulus – Guardian

Fosters all around

3/12 US producer prices post biggest drop in five years – CNBC

3/12 WHO proposes use of digital payments against the coronavirus – Broker

We don't need no stinkin paper money.

Armstrong, Meanwhile, we have complete idiots running the ship who only care about people not getting the flu with no regard to what they are doing to the global economy. We are at the stage where they are bringing down the entire structure globally. An invisible virus has exposed our true strengths and weaknesses. It has also exposed the structural faults in our systems under Keynesian Economics.

This CaronaGate was perhaps intentional to gain more power, as was the case out of 9/11. Perhaps it is the product of absolute idiots who only think about stopping a pandemic that has a lower mortality rate than the general flu virus. Either way, we are looking at serious economic implications for their means of fighting a flu that has amounted to an economic policy of scorched earth."

Remember that Armstrong predicted the collapse of the Treasury bond market.

"The Market Is Broken" - Why Nobody Is Trading Any More

Panic & The Pandemic: Is There A Better Approach?

Our society is now transitioning into panic about the coronavirus...

Nomura: "The Market Has Only Just Begun Staring Into The Abyss"

The plunge in US equities pushed weekly returns down to 7.7 standard deviations below the norm.... we can say with confidence that we are witnessing a history-making market disaster in real-time."

US Equity Market Crashes Below 2007 Highs Despite Massive Surge On Trump Stimulus Plan

From our wannabe "imbecile in chief"

First Point Of Joe Biden's Covid-19 Action Plan Is To Stop "Racism"

because preventing hurt feelings is a really important priority when dealing with a global pandemic.

Something Is Breaking: Fed Fails To Ease Epic Dollar Shortage As FRA/OIS Goes Parabolic

Even as stocks surge, the interbank funding market is approaching a state of total paralysis. Unless this is fixed, and soon, total systemic collapse may follow.

"The Biggest VaR Shock In History": Here's The Reason Behind The Market's Insane Moves In One Chart

"American Carnage" In Ten Bullet Points

Global recession began last week driven by virus + oil + asset prices...credit markets effectively closed, spreads discounting credit events in corporate debt, private equity/shadow banking, risk parity, emerging markets.

"This Is Just The Beginning": Shocked Wall Street Traders Respond To An Insane Market

Will The Coronavirus Kill The New World Order?

Goodbye To All That: The Demise Of Globalization And Imperial Pretensions

'Rohrkrepierer' - How The Fed's Giant Bazooka Misfired

This Wasn't Supposed To Happen: FRA/OIS Explodes Higher After Fed's "Bazooka Repos" Misfire

"There Will Be Liquidity, This Is Not 1987" Mnuchin Vows As He Urges Banks To Use Discount Window

"For long-term investors, this will be a great investment opportunity".

Blain: "Step Back, Hunker Down, Get Ready..."

Perhaps it’s time to think the unthinkable and close markets for a few weeks?

Is South Korea About To Unleash A Neutron Bomb Across Global Stock Markets

When Will Authorities 'Lockdown' America (& How Long Will Quarentine Last)? Here's What The Patterns Show Us

Global Liquidation Resumes: Japan Jolted, Crypto Collapses, China Crushed

Black Thursday: "One Giant Margin Call" Drags Dow Down 10%

Comment

Go Trump baby. The smart money "LOOK AT ALL THAT GREEN TIME TO BUY" I told you guys.

Go Trump baby. The smart money "LOOK AT ALL THAT GREEN TIME TO BUY" I told you guys.

Comment